Colin listed his assets and liabilities – Colin’s decision to list his assets and liabilities marks a crucial step towards understanding his financial standing. By meticulously documenting his financial holdings, Colin embarks on a journey of financial awareness, empowering him to make informed decisions and navigate his financial landscape with confidence.

This comprehensive guide delves into the significance of asset and liability listing, providing a roadmap for Colin to effectively manage his finances. Through a detailed analysis of Colin’s financial situation, we explore the potential reasons behind his actions and the implications they may have.

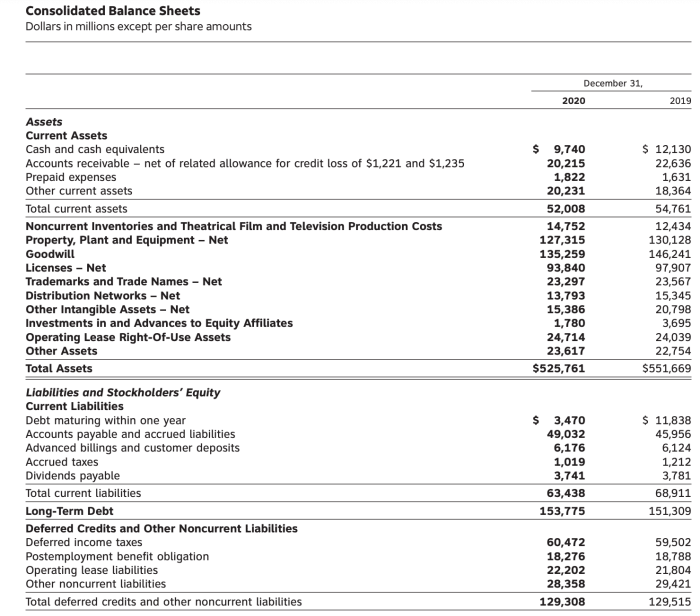

Assets and Liabilities

Assets and liabilities are fundamental components of any financial statement. Assets represent the economic resources owned by an individual or entity, while liabilities are the financial obligations that must be fulfilled.

It is crucial to list assets and liabilities to gain a clear understanding of one’s financial position. This information provides insights into the value of assets, the extent of liabilities, and the overall financial health of an individual or organization.

Common Assets

- Cash and cash equivalents

- Investments (stocks, bonds, mutual funds)

- Real estate

- Vehicles

- Equipment

Common Liabilities

- Mortgages

- Loans (personal, student, business)

- Credit card debt

- Taxes

- Accounts payable

Colin’s Financial Situation

Colin’s decision to list his assets and liabilities could be motivated by several factors, including:

- Tracking his financial progress and identifying areas for improvement

- Preparing for a significant financial event (e.g., buying a house, starting a business)

- Managing debt and improving his credit score

- Gaining a better understanding of his financial situation

Colin’s financial situation may reveal strengths, weaknesses, and potential risks. It is important for him to analyze his assets and liabilities carefully to make informed financial decisions.

Methods for Listing Assets and Liabilities

To list assets and liabilities effectively, follow these steps:

- Identify your assets:Include all tangible and intangible assets, such as cash, investments, real estate, and intellectual property.

- Value your assets:Determine the current market value of your assets based on reliable sources or appraisals.

- List your liabilities:Include all financial obligations, such as mortgages, loans, and credit card debt.

- Quantify your liabilities:Determine the outstanding balance and interest rates for each liability.

Table: Asset and Liability Listing, Colin listed his assets and liabilities

| Assets | Value | Liabilities | Outstanding Balance |

|---|---|---|---|

| Cash | $10,000 | Mortgage | $200,000 |

| Investments | $50,000 | Student Loans | $30,000 |

| Real Estate | $250,000 | Credit Card Debt | $5,000 |

Benefits of Listing Assets and Liabilities: Colin Listed His Assets And Liabilities

Listing assets and liabilities offers several benefits:

- Improved financial understanding:Gaining a clear picture of your financial situation helps you make informed decisions.

- Better financial planning:By knowing your assets and liabilities, you can plan for future financial goals and emergencies.

- Increased creditworthiness:A well-managed list of assets and liabilities can improve your credit score and access to loans.

- Reduced financial stress:Understanding your financial position can alleviate stress and anxiety.

Table: Benefits vs. Drawbacks of Listing Assets and Liabilities

| Benefits | Drawbacks |

|---|---|

| Improved financial understanding | Can be time-consuming |

| Better financial planning | May reveal financial weaknesses |

| Increased creditworthiness | Requires ongoing maintenance |

| Reduced financial stress | Can be emotionally challenging |

Considerations for Colin

When listing his assets and liabilities, Colin should consider the following:

- Accuracy:Ensure that the values of assets and liabilities are accurate and up-to-date.

- Categorization:Organize assets and liabilities into appropriate categories (e.g., current, non-current, secured, unsecured).

- Potential risks:Identify any potential risks associated with his assets or liabilities, such as market volatility or debt obligations.

- Long-term financial goals:Consider how his assets and liabilities align with his long-term financial goals.

By carefully considering these factors, Colin can create a comprehensive and informative list of his assets and liabilities.

Frequently Asked Questions

Why is it important for Colin to list his assets and liabilities?

Asset and liability listing provides Colin with a comprehensive snapshot of his financial position, allowing him to assess his net worth, identify areas for improvement, and make informed decisions about his financial future.

What are some potential challenges Colin may face when listing his assets and liabilities?

Colin may encounter challenges such as accurately valuing certain assets, dealing with complex financial instruments, or facing emotional attachments to certain possessions. It is crucial to approach the process with objectivity and seek professional guidance if needed.